As cryptocurrency continues to reshape the financial landscape, Texas has positioned itself as one of the leading states for blockchain technology and digital asset innovation. The state’s favorable regulatory environment, abundant energy resources, and business-friendly policies have made it a hotspot for crypto startups, miners, and investors. At the same time, challenges related to energy consumption, regulatory clarity, and market volatility continue to shape the discourse surrounding digital currencies in the Lone Star State. This article explores the rise of cryptocurrency in Texas, examining the state’s policies, economic impact, notable players, and the pros and cons of its approach.

The Role of Energy in Texas’ Crypto Surge

One of the main factors driving Texas’ cryptocurrency boom is its energy abundance. The state is a major producer of natural gas and also leads the nation in wind power generation. Cryptocurrency mining, particularly Bitcoin mining, is energy-intensive, and Texas’ cheap, abundant, and increasingly renewable energy sources have made it a preferred destination for miners looking for low-cost power.

For example, in 2021, it was estimated that Texas was home to 14.5% of the world’s Bitcoin mining operations, ranking second only to China before the latter’s crackdown on miners. The state’s grid, which is largely independent from the rest of the U.S., can be an advantage in times of low energy demand, although it has also led to concerns over how mining could impact grid reliability during peak demand periods (such as extreme summer heat).

Prominent Crypto Players in Texas

Some of the biggest names in cryptocurrency and blockchain have set up shop in Texas. These include Bitcoin mining firms, blockchain startups, and other major players in the industry.

– Riot Blockchain: One of the largest publicly traded Bitcoin mining companies, Riot Blockchain, operates one of the world’s largest Bitcoin mining facilities in Rockdale, Texas. With access to inexpensive power, Riot has made significant investments in scaling its mining operations, contributing to Texas’ status as a global Bitcoin mining hub.

– Bitmain Technologies: A major player in the production of mining hardware, Bitmain has also established a large mining facility in Texas. The company’s decision to base operations in the state highlights its growing importance in the crypto ecosystem.

– Blockstream: Blockstream, a global leader in blockchain technology and Bitcoin infrastructure, has launched initiatives in Texas aimed at advancing Bitcoin’s adoption and integration into financial systems. Their facilities in the state are vital to both mining and development efforts.

Legislative Framework: Pro-Crypto Policies and Initiatives

1. Legal Recognition of Virtual Currency

In 2019, Texas passed Senate Bill 112, which legally recognizes virtual currencies, like Bitcoin, as a form of property under state law. This law provides legal clarity for those involved in crypto transactions and solidified Texas as a crypto-friendly state. The bill defined digital currencies as “a medium of exchange in the digital economy” and allowed businesses to use them as a form of legal property.

2. The Texas Blockchain Council (TBC)

Formed in 2021, the Texas Blockchain Council (TBC) is an influential advocacy group that works to support blockchain adoption and ensure Texas remains at the forefront of the industry. The council has played a significant role in engaging with state legislators and has been instrumental in shaping the state’s policy towards cryptocurrency and blockchain.

TBC members include some of the most influential figures in the Texas crypto scene, including executives from companies like Riot Blockchain, Blockstream, and Bitcoin.com. The council’s efforts have been pivotal in keeping the state’s regulatory environment conducive to innovation.

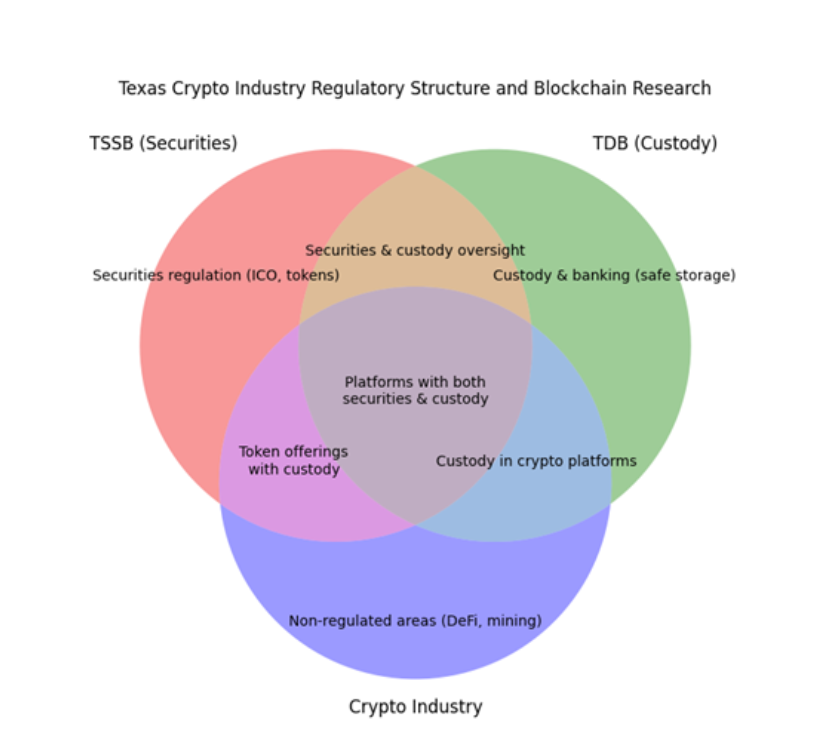

3. Regulatory Oversight and Enforcement

While Texas has generally taken a light regulatory touch, the state still has some level of oversight over cryptocurrency activities. The Texas State Securities Board (SSB) and the Texas Department of Banking have issued guidelines for cryptocurrency businesses to ensure compliance with existing state laws, such as those relating to fraud and money laundering. For instance, the SSB has taken action against crypto companies engaging in unregistered securities activities or offering products that violate state law.

Economic Impact

– Boost to the Fintech Sector: Texas has become a hotbed for fintech startups, many of which leverage blockchain technology for a range of applications, from decentralized finance (DeFi) platforms to supply chain management. Cities like Austin and Dallas are quickly becoming key hubs for blockchain entrepreneurs, providing a strong environment for fintech innovation.

– Tax Revenue: The growth of the cryptocurrency industry has also boosted state revenue. Mining operations and blockchain companies contribute significantly to local economies, paying taxes on infrastructure, energy use, and payrolls. Moreover, increased business activity in sectors tied to blockchain technology, such as cybersecurity and software development, has brought in additional revenue streams for the state.

Challenges and Drawbacks: Energy Use and Regulatory Uncertainty

1. Energy Consumption and Environmental Concerns

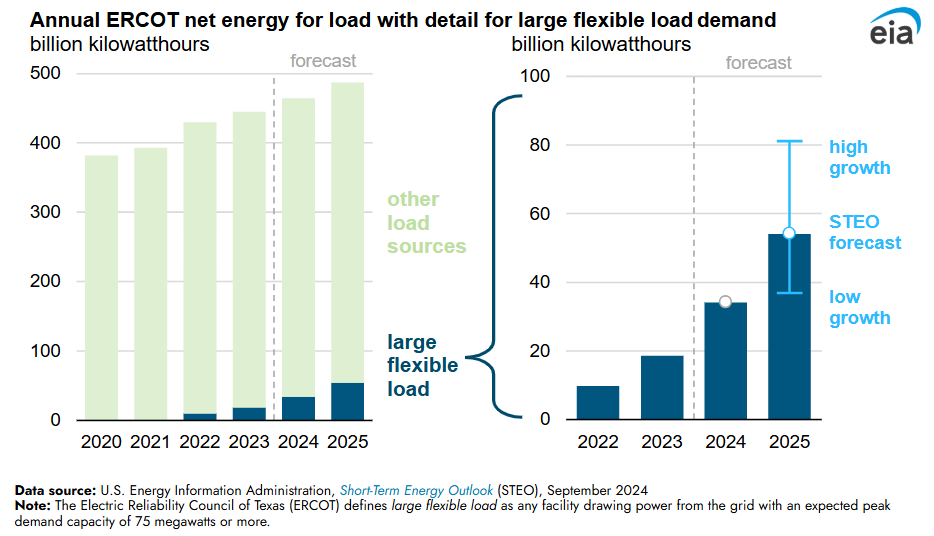

Bitcoin mining operations consume vast amounts of electricity, and concerns have been raised over whether the surge in demand for energy from miners is putting a strain on Texas’ power grid. As miners flock to Texas for its cheap energy, the state’s grid operator, ERCOT (Electric Reliability Council of Texas), has expressed concerns about how large-scale mining could affect grid reliability during extreme weather events, such as the 2021 winter storm that led to widespread power outages.

2. Regulatory Uncertainty

While Texas’ crypto policies are relatively favorable, the regulatory environment remains somewhat uncertain, especially with potential federal regulation on the horizon. The U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) are working to establish clearer federal guidelines for digital assets, and Texas may eventually need to adapt its laws to align with national standards.

3. Market Volatility and Risk of Scams

The volatile nature of cryptocurrency markets presents significant risks. Texas is not immune to the dangers of speculative bubbles, market downturns, and scams. The state’s relatively relaxed regulatory environment has attracted both legitimate businesses and bad actors, leading to concerns about consumer protection and the potential for fraudulent schemes.

The Future of Crypto in Texas

Looking forward, Texas will continue to be a key player in the cryptocurrency landscape. With its pro-business stance, robust energy resources, and growing network of blockchain companies, the state is likely to maintain its position as a global crypto hub. However, balancing the need for innovation with concerns over energy use, market volatility, and regulatory uncertainty will be critical to the state’s long-term success in the space.